Homeowners in Hamilton County, Ohio, are facing a daunting reality: a more than twofold increase in property taxes over the past six months.

Property Tax Shock

WXIX in Cincinnati reveals that property taxes for several homeowners in the county have skyrocketed by nearly 500 percent, pushing many to the brink as they struggle to meet the February 5 payment deadline.

Locals have expressed fears of being forced out of their homes without aid.

Distressed Homeowner

Latasha Shields, a homeowner, shared her distress, revealing her tax payment jumped from under $700 to $1,700. “I’m living more for my kids and I’m wondering if they’ll be able to keep my house if I’m not here,” Shields expressed.

Statewide Struggle

This surge in property taxes isn’t confined to Hamilton County. By the end of last year, Ohioans statewide were grappling with higher property taxes, triggered by a state-required property assessment that occurs every six years.

Sky-High Valuations

In November, appraisers in counties like Ashland, Ashtabula, Geauga, Richland, Summit, and Wayne reported seeing residential property values jump by an average of over 30 percent following these reappraisals, as WEWS in Cleveland reported.

‘Flawed’ Tax Formula

Hamilton County Commissioner Alicia Reece has criticized the state’s property tax formula as ‘flawed,’ highlighting that some residents are paying more in property taxes than their mortgage payments.

Reece is actively seeking temporary solutions to alleviate the burden of soaring property taxes and high mortgage costs in Hamilton County.

Searching for Solutions

While Hamilton County grapples with these tax hikes, the problem is far-reaching in Ohio, with expectations of it intensifying in the next few years. Other counties like Cuyahoga, Erie, Huron, Lake, Lorain, Portage, and Stark are on the agenda for property reassessments this year, signaling potential tax increases soon.

A New Formula

As Commissioner Reece and her colleagues seek immediate remedies, Ohio legislators are focusing on a more long-term approach with House Bill 187. This bill proposes a new formula for calculating home property taxes, taking into account property values over the past three years instead of just one.

It would also prevent the state’s Department of Taxation from mandating counties to increase their property tax values if deemed too low.

Facing Official Opposition

Having already cleared the Ohio State House, the bill’s next hurdle is the state Senate. If passed, it will remain effective for three years. Despite its progress, the bill has been met with resistance from county auditors and treasurers.

Their associations, in an October statement, argued that the bill would cause significant disruptions in tax collection and necessitate redoing recent property reappraisals.

Expert Advice on Soaring Taxes

Dannel Shepard, a realtor from the LAZO Group at Re/Max, offered advice to Ohioans grappling with soaring property tax bills.

“If you have a settlement statement, if you recently bought or you can take your recent appraised value and go to the county—you can actually go to quote on quote to say ‘hey what happened and why’ even though they try to give you the explanation for it, but there’s ways you can try to protect yourself if you feel like man this is way too much,” Shepard said.

Higher Taxes, Higher Home Equity

Shepard points out that rising property taxes indicate boosted home values and equity, urging homeowners to discuss options like Home Equity Lines of Credit (HELOC) with their lenders. For homeowners questioning their monthly bills, Shepard advises appraisals, which typically cost a couple of hundred dollars.

Homeowners Struggle in Walnut Hills

In Walnut Hills, several homeowners have reported a staggering 500% increase in property taxes. Meanwhile, residents in Butler County brace for an anticipated 40% hike starting in February. Only two other counties, Clermont and Knox, have been recommended for increases of 40% or more.

Read Next: What Really Causes Donald Trump’s Skin to be So Orange

Former President Donald Trump’s distinctive orange skin has captivated attention, sparking curiosity about its evolution from average pale over the years:

What Really Causes Donald Trump’s Skin to be So Orange

27 Things MAGA Movement Ruined Forever for People

How the MAGA movement left its mark on individuals and disrupted certain aspects of our everyday life forever:

27 Things MAGA Movement Ruined Forever for People

Court Finally Unseals Secretive Case of Jan 6 Offender

Samuel Lazar sentenced for Jan. 6 insurrection; previously confidential case now revealed: Court Finally Unseals Secretive Case of Jan 6 Offender

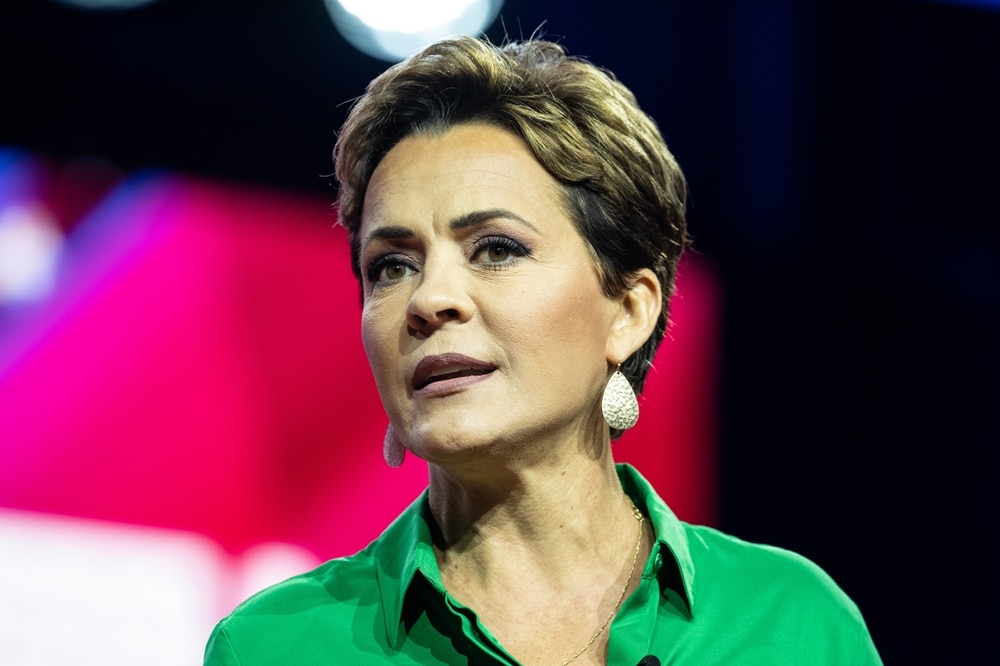

Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

Kari Lake loses First Amendment right to accuse Maricopa County recorder; Arizona Republic ponders if she’s channeling Rudy Giuliani in her sleep : Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

More Democrats are flipping in a crucial swing state than Republicans

In Pennsylvania, a significant number of registered Democrats flipping is sending an unflattering signal to President Biden: More Democrats are flipping in a crucial swing state than Republicans