A shift has occurred in the rooftop solar industry, transitioning from straightforward panel sales to more complex financial transactions involving leases or loans. This change has caught many consumers off-guard, leading to significant financial burdens.

Homeowner’s Financial Shock

Mary Ann Jones, an 83-year-old resident, told the Times that she was unexpectedly burdened with a hefty solar panel loan from GoodLeap, totaling over $52,000, which extends to her 106th year. This loan exceeds the original cost of her house.

Misleading Sales Tactics

In Jones’ case, a Solgen Construction salesman presented the solar panels as part of a utility-linked government program, misleading her into unwittingly signing a loan agreement. This tactic, involving deceptive email usage and targeting fixed-income individuals, is becoming alarmingly common.

Deception Allegations

Jones claims that she was deceived into signing up for the service; she is currently engaged in a legal battle against both Solgen and Goodleap.

Consumer Legal Battles

Kristin Kemnitzer, a consumer law attorney, notes a surge in cases similar to Jones’, where solar salespeople obscure contract terms, leading to a growing number of legal disputes across the country.

Financial Turmoil

The solar industry faces more than customer dissatisfaction; major solar firms are struggling financially, raising doubts about their business models. This instability threatens the industry’s future despite solar’s potential to greatly contribute to the nation’s energy needs and reduce reliance on fossil fuels.

Inflation Reduction Act

The Inflation Reduction Act’s 30% tax credit for solar and battery installations aims to encourage growth, but the sector’s financial woes pose a significant challenge.

Solar Industry’s Downward Spiral

Recent times have seen over a hundred solar dealers and installers filing for bankruptcy. Major players in the industry, SunRun and Sunnova, have reported substantial losses, with their shares plummeting sharply since January 2021.

Solar Financialization

The practice of using Wall Street funding to fuel growth in the solar industry has led to increased consumer costs and aggressive sales strategies. This financialization has transformed national solar companies into finance entities, focusing on solar leases and loans.

High Costs Hurdles

Residential solar initially faced hurdles due to high installation costs, deterring consumers from making large upfront payments for an emerging technology.

Innovative Step

SolarCity, in the early 2010s, innovated by leasing panels to homeowners, reducing or eliminating these initial costs. This model was quickly adopted by other companies, which led to a boom in residential installations by 2014.

Leasing Model’s Impact

This leasing approach not only facilitated sales but also allowed SolarCity to benefit financially by claiming government-approved tax credits. This model, however, placed pressure on solar companies to rapidly expand, often at the expense of consumer interests.

Slowing Growth Rate

Research firm Wood Mackenzie forecasts a slowdown in the residential solar sector’s growth. Following significant increases of 31% in 2021 and 40% in 2022, the market is expected to expand by only 13% in 2023.

Expected 2024 Contraction

A contraction of 12% is also anticipated in 2024, indicating a notable decrease in the sector’s expansion pace due to higher interest rates and legislative changes.

Solar Industry Optimism

Despite predictions of a downturn, representatives from the residential solar sector remain optimistic. Stephanie Bosh, Vice President of Communications for the Solar Energy Industries Association, counters the notion of an industry crisis.

Projected Surge

Bosh highlights that while installations may drop in 2024, the number of homes equipped with rooftop solar is projected to rise significantly, from the current 4 million to 10 million by 2030.

Compromised Ethics

As solar companies strive for rapid sales, there’s growing concern over their tolerance of questionable sales tactics. Allegations point to salespeople distorting the true terms and costs of solar panel loans and leases, causing financial strain for consumers.

Ethical Standards

Additionally, deceptive practices in solar financing, such as unclear dealer fees, have imposed unexpected costs on consumers. These practices cast doubt on the transparency and ethical standards within the solar finance industry.

Legal and Regulatory Challenges

The lack of regulatory action against dubious practices in the solar industry is alarming. Some cases have resulted in significant awards to plaintiffs, but arbitration requirements hinder many.

Uncertain Future

Solar job losses and industry challenges hint at a challenging future for residential solar, as California alone lost over 17,000 jobs in 2023. Analysts predict a possible industry collapse, while others anticipate a recovery after a tough few years.

Aggressive Marketing

Despite numerous cases of financial distress among consumers, the aggressive marketing of rooftop solar continues.

Read Next: What Really Causes Donald Trump’s Skin to be So Orange

Former President Donald Trump’s distinctive orange skin has captivated attention, sparking curiosity about its evolution from average pale over the years:

What Really Causes Donald Trump’s Skin to be So Orange

27 Things MAGA Movement Ruined Forever for People

How the MAGA movement left its mark on individuals and disrupted certain aspects of our everyday life forever:

27 Things MAGA Movement Ruined Forever for People

Court Finally Unseals Secretive Case of Jan 6 Offender

Samuel Lazar sentenced for Jan. 6 insurrection; previously confidential case now revealed: Court Finally Unseals Secretive Case of Jan 6 Offender

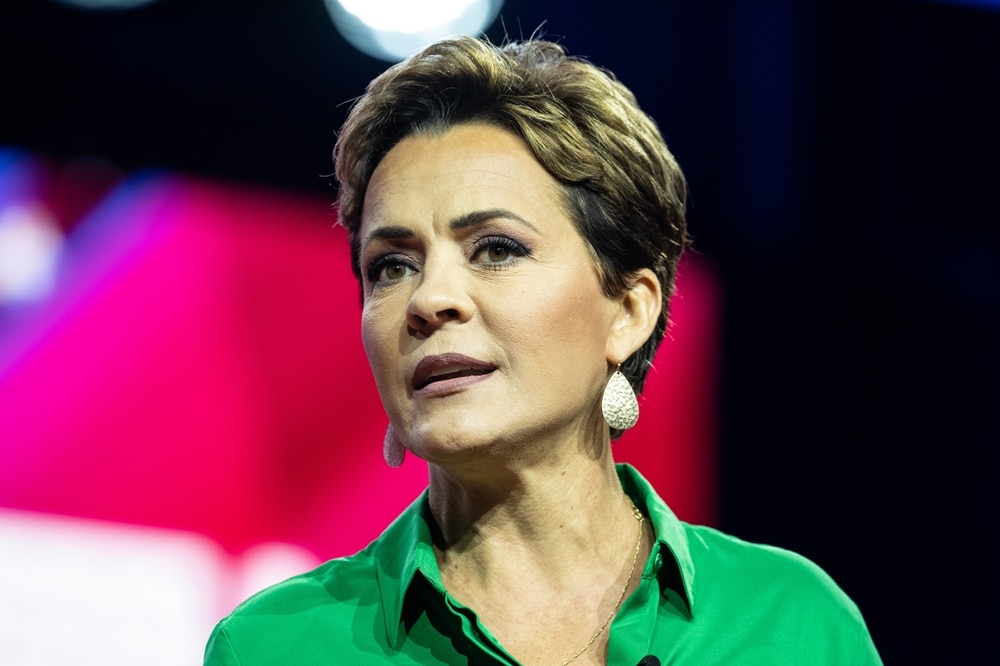

Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

Kari Lake loses First Amendment right to accuse Maricopa County recorder; Arizona Republic ponders if she’s channeling Rudy Giuliani in her sleep : Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

More Democrats are flipping in a crucial swing state than Republicans

In Pennsylvania, a significant number of registered Democrats flipping is sending an unflattering signal to President Biden: More Democrats are flipping in a crucial swing state than Republicans