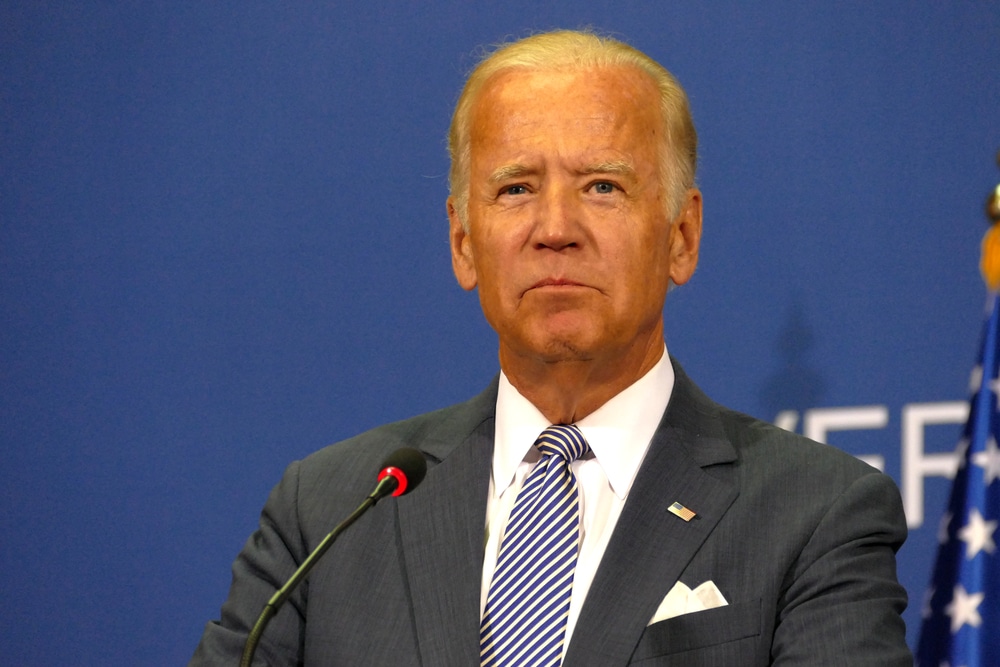

In December, rules governing the disbursement of tax credits for hydrogen power production were finally released. The strictness of the regulations has angered clean energy groups and some Democratic lawmakers, prompting the usual Biden allies to voice their frustrations with the Administration’s decision.

Next-Gen Power

Hydrogen power production is a critical tool for achieving a carbon-neutral future, but its production often requires vast amounts of power. If fossil fuels generate that power, it could cancel out or even outweigh the carbon benefits of using hydrogen as a power source.

Generous Credit

The Inflation Reduction Act, President Biden’s landmark climate legislation, includes an extremely valuable tax credit for producing hydrogen worth up to $100 billion and is available for ten years. “The IRA’s section 45V production tax credit is the most generous clean hydrogen subsidy in the world,” Jesse Jenkins, a professor of macro-scale energy systems at Princeton University, told CNBC in October.

Tricky Business

“But without proper implementation,” the professor continued, 45V could backfire, wasting a tremendous opportunity for the United States to become a global leader in new clean industries and causing a significant increase in domestic emissions that imperil U.S. climate goals.”

One or the Other

There are two schools of thought. The first argues that the credits must be structured in a way that prioritizes reduction in emissions from the beginning, while the other contends that the focus must be on scaling clean power production.

One Side

Those who favor focusing on quick scaling argue that some extra emissions are worth creating widespread infrastructure for clean power generation. However, others point out that the costs of allowing increased emissions in the early stages of production could outweigh the benefits entirely.

Potential Disaster

“Absent strong rules, we could increase emissions by half a gigaton over the lifetime of the credit” for hydrogen production, a clean energy advocate at the Natural Resources Defense Council told Grist in March this year, when the structure of the credits was still being debated. “The current emissions of the power sector is 1.5 gigatons. So this is completely contrary to U.S. climate goals. The stakes are extremely high.”

Problem of Definition

The central issue in the implementation of this tax credit is how to decide whether the hydrogen has genuinely been produced cleanly. The “three pillars” defining whether hydrogen is clean are additionality, regional deliverability, and hourly matching.

Diving In

If any of the three pillars is removed, “the whole ‘clean’ hydrogen house comes tumbling down,” Jenkins explained. Electricity to produce clean hydrogen must come from newly built sources of clean energy, be able to physically travel from where it is produced to where the hydrogen is produced, and be accounted for hourly.

Strict Rules

In the end, the Biden Administration decided to structure the credits in a way that attempts to prevent “any possibility of emissions increases during initial commercial deployment,” said the CEO of the American Clean Power Association. To be awarded the maximum credit, hydrogen producers must obey a long list of rules that firmly enforce the three pillars.

Complaints

Grumet is one of several usual Biden allies that are unhappy with this. “The rushed imposition of the most burdensome restrictions,” he argued, “fails to acknowledge the market realities of new technology deployment.”

Potential Change

The strictness of the regulations could be “jeapordizing the clean hydrogen industry’s ability to get off the ground,” argued Democratic Sen. Tom Carper. Carper, Grumet, and other opponents have announced that they will attempt to revise the rule.

More from AllThingsFinance: Court Finally Unseals Secretive Case of Jan 6 Offender

Samuel Lazar sentenced for Jan. 6 insurrection; previously confidential case now revealed: Court Finally Unseals Secretive Case of Jan 6 Offender

Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

Jack Smith urges Judge Aileen Cannon for a speedy trial in a classified documents case involving ex-President Trump: Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

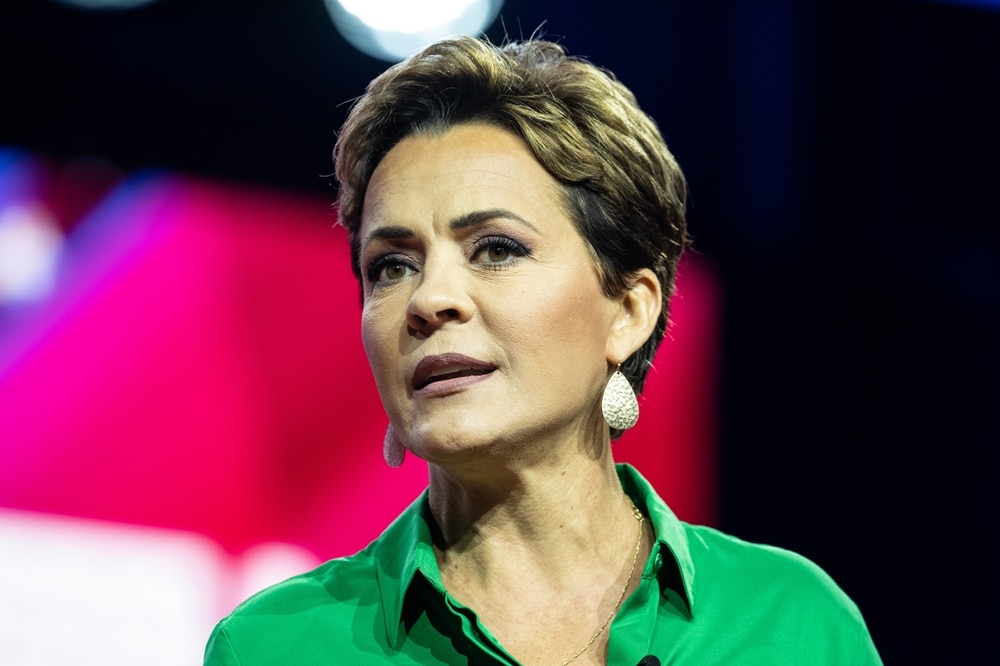

Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

Kari Lake loses First Amendment right to accuse Maricopa County recorder; Arizona Republic ponders if she’s channeling Rudy Giuliani in her sleep : Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

More Democrats are flipping in a crucial swing state than Republicans

In Pennsylvania, a significant number of registered Democrats flipping is sending an unflattering signal to President Biden: More Democrats are flipping in a crucial swing state than Republicans