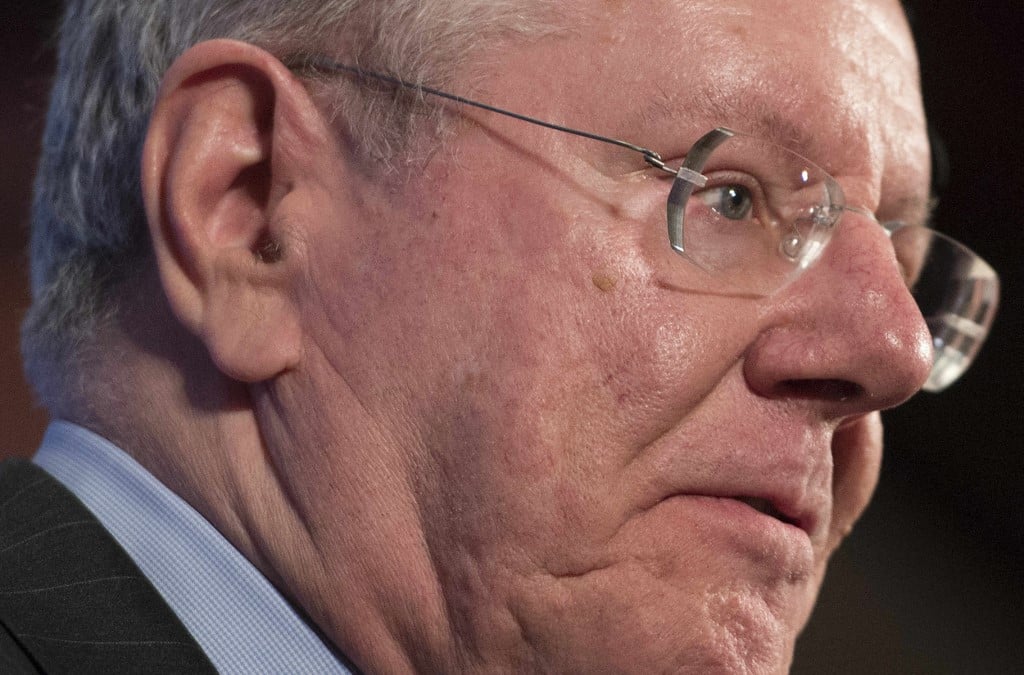

On Saturday, Forbes published a video of its editor-in-chief, Steve Forbes, arguing against the hypothetical new tax.

Hyperbolic threats

In the video, Forbes called California the “North Korea of Taxation.” He argued that the proposed wealth tax would cause widespread litigation, the depreciation of assets, and the widespread flight of wealthy Californians.

The tax in question

The proposed tax was introduced by state Assemblymember Alex Lee. On the same day, lawmakers in seven other states introduced similar proposals to tax what Lee called “extreme wealth.”

The specifics

Only people worth $50 million or more would be affected. These individuals would have to pay a 1% tax on their wealth. Anything beyond $1 billion would be taxed at 1.5%

Who is affected?

Only 23,000 households — the wealthiest 0.1% of Californians — would be affected by the new tax. Forbes’s net worth is about $430 million, according to Investopedia.

Money raised

However, because that 0.1% has accumulated so much wealth, the tax would raise more than $21 billion for the state per year. That’s about the same amount as California’s current budget deficit.

No escape

Under the proposal, the state would tax even part-time residents, calculating what they owe based on how long they spend in California. This is a new addition to the law, which Lee proposed last year with no success.

Everything considered

According to Cal Matters, the proposed tax “would apply to assets including shares of privately owned companies, art, and collectables, ‘financial assets held offshore’ and more.”

No hiding wealth

Forbes slammed the proposal as a gross overreach and invasion of privacy. State officials would have the power to examine non-publicly traded assets and file suits against individuals suspected of hiding assets.

Make cheats pay

In 2021, the IRS estimated that the US loses about $1 trillion every year as a result of unpaid taxes. “Nurses and firefighters have to pay with every paycheck,” the agency’s then-commissioner said, while “many highfliers can get off.”

Paying dues

Additionally, California estimated in 2022 that it would lose almost $70 billion that financial year as a result of tax breaks, which largely went to wealthy individuals and corporations. “This revenue loss,” the state’s report noted, “equals approximately one-third of the state’s 2021-22 General Fund budget and represents dollars the state could otherwise use to support Californians to live, work, and thrive across the state.”

You can run, but you can’t hide

Forbes argued that those targeted by the new tax would leave California, exacerbating the population decline. Lee acknowledged this argument but claimed the proposal adopted a “strategy of ‘You can run, but you can’t hide.’”

Fake news

In 2018, a Cornell sociologist and an economist at the US Treasury published a study examining whether millionaires flee areas with higher taxes. One thing they analyzed was the fallout of a tax increase in 2004. They found that “the rate of top earners leaving the state actually declined slightly after the 2004 tax increase, while the almost-top earners continued to leave at the same rate,” according to Cornell’s Department of Sociology. “In other words, the 2004 tax increase didn’t drive the people paying a larger bill out of the state.”

Who taxes more

According to a 2023 study by Fortune, the effective state and local tax rate for the median US household in California is about 8.97%. In comparison, in Texas, it is 12.73%.

Who actually pays more tax

“When people are like, ‘Oh, California is so much more expensive than Texas,’ that’s the top income tax rate. That’s on people earning over $1 million,” explained Richard Auxier, a tax policy expert.

More from AllThingsFinance: Court Finally Unseals Secretive Case of Jan 6 Offender

Samuel Lazar sentenced for Jan. 6 insurrection; previously confidential case now revealed: Court Finally Unseals Secretive Case of Jan 6 Offender

Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

Jack Smith urges Judge Aileen Cannon for a speedy trial in a classified documents case involving ex-President Trump: Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

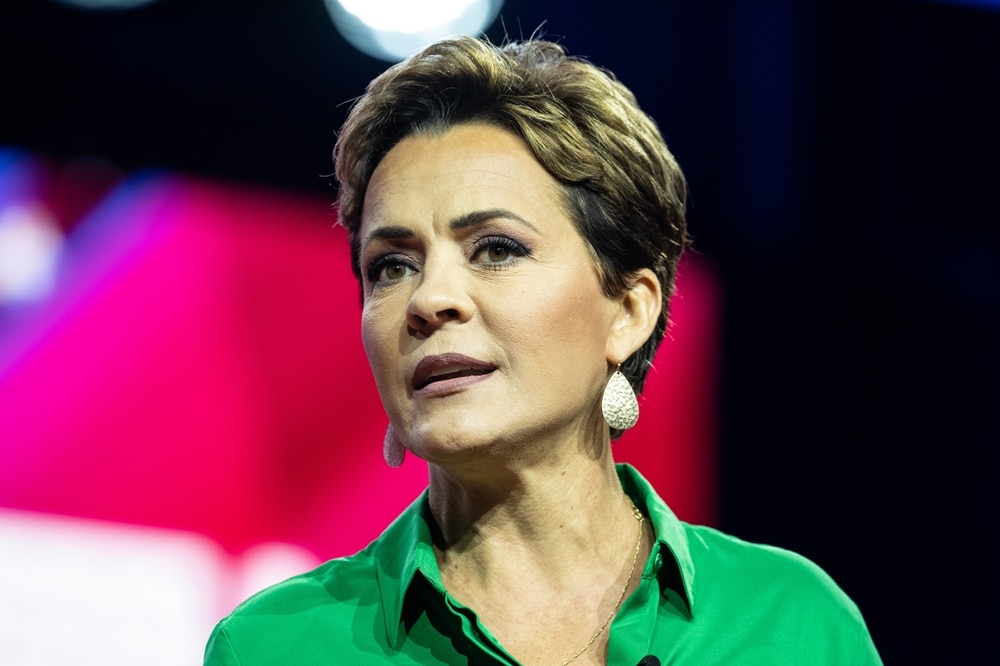

Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

Kari Lake loses First Amendment right to accuse Maricopa County recorder; Arizona Republic ponders if she’s channeling Rudy Giuliani in her sleep : Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

More Democrats are flipping in a crucial swing state than Republicans

In Pennsylvania, a significant number of registered Democrats flipping is sending an unflattering signal to President Biden: More Democrats are flipping in a crucial swing state than Republicans