The brokerage industry has changed greatly over the last decade. It is now possible to buy and sell practically any security online, yet people still insist on paying hundreds of dollars for a broker to do it for them. I’m not saying that managing your own investment portfolio is for everyone, but for the majority of investors, the possibility is very real and rewarding.

The brokerage industry has changed greatly over the last decade. It is now possible to buy and sell practically any security online, yet people still insist on paying hundreds of dollars for a broker to do it for them. I’m not saying that managing your own investment portfolio is for everyone, but for the majority of investors, the possibility is very real and rewarding.

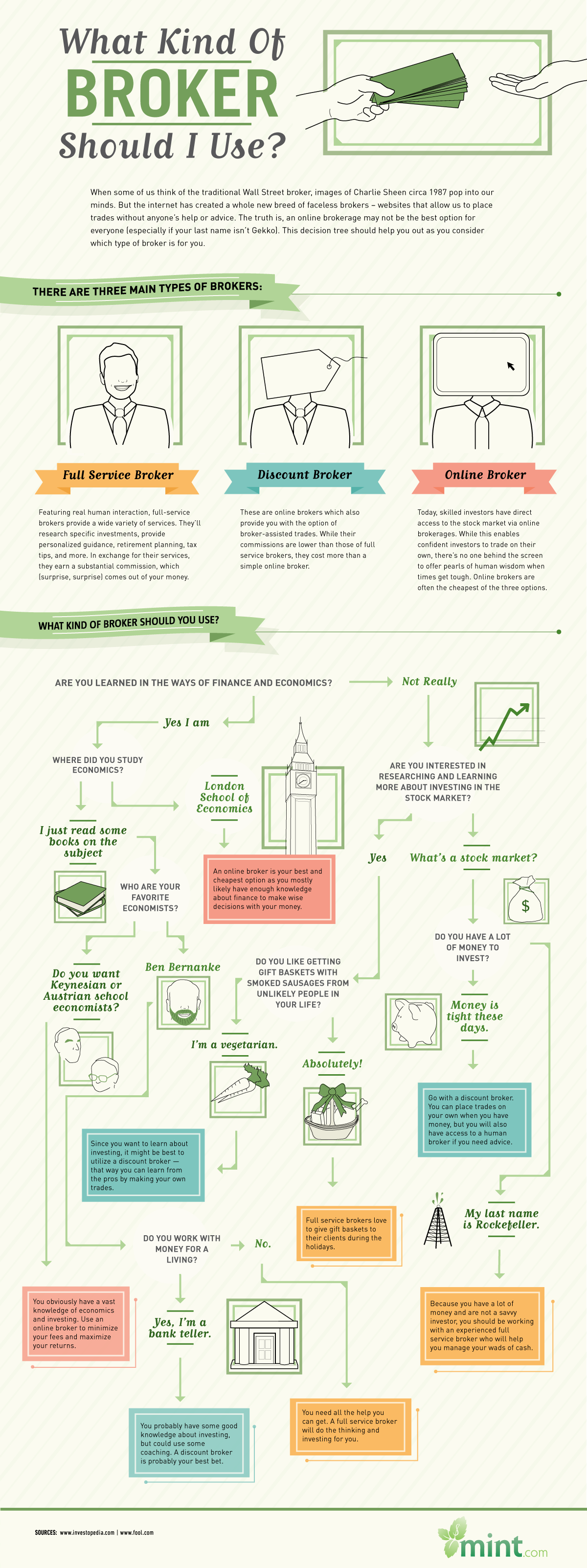

Today’s infographic makes it very easy for you to decide what kind of broker is for you: full service, discount or online.

Online

Personally, I love using an online firm as I’m the type of trader that does tons of research, performs daily chart analysis, constantly searches for news stories, etc. I know I’m responsible for my own portfolio and if I fail, it’s nobody’s fault but my own. To some, this may seem frightening, but at least you know you can trust your money manager (yourself) not to disappear with the majority of your net worth.

Today’s infographic makes it seem like you’re completely on your own, but that’s not entirely true. The majority of online brokerage firms will gladly assist you if you have questions or run into problems. There are however, some with no live support at all. Next week, I will focus on a variety of online firms and announce the ones I recommend.

Discount

The distinction between online and discount has become blurred over the last few years. Industry competition has forced online firms to offer support and even investment education while discount firms have lowered their commissions to compete with the online brokers. Full-service firms have even absorbed smaller companies to offer competing services.

For example, if you Google “discount brokers”, the top three search results are Scottrade, Fidelity and TD Ameritrade (you might even come across another E*Trade overseas when looking for share trading Australia). All three of these firms offer online trading as well a variety of other services such as in-office training and portfolio management combined with ultra low costs.

Full Service

The way I see it, full service brokerage firms are for three kinds of people – those who with not enough time to invest, others with enough money to pay someone else to do it for them and those that can’t pick a winning stock to save their life.

If you hold a full-time job that’s not in the financial sector, it can be very difficult to put in the time required to be a successful investor. Not many people want to come home and sit in front of a computer to conduct stock research when they’ve already been staring at a screen all day.

As much as I love trading and investing, if I was sitting on at least a few million dollars, I would gladly pay someone else to invest for me while I travel the world. Even if you plan on holding a security for a months and perhaps years, you need someone to keep an eye on your assets for you. There’s no Wi-Fi out at sea or in that remote town you love to visit in Italy.

Finally, individuals that have tried investing on their own only to loose money from the majority of their investments are better off hiring someone to do it for them. I feel really bad for the people that seem to consistently buy at the top and sell at the bottom no matter what kind of strategy their using. Sure, you’re going to pay around 1% of your total portfolio value if you pick a fee-based advisor, but a 1% fee coupled with an 8% gain is better than no management fee and a 10% loss.

READERS: What kind of broker do you use? Which do you prefer and why?