California is grappling with a financial crisis of unprecedented proportions as it stares down the barrel of a staggering projected deficit of as high as $68 billion for this fiscal year.

California’s Fiscal Challenges

The Golden State is weighed down by colossal unfunded liabilities, including an estimated $150 billion for retiree health insurance and pension deficits that have ballooned to over $1 trillion.

Stock Market’s Performance

The challenging stock market conditions in 2022 also led to a revenue deficit from the expected capital gains taxes in a system heavily reliant on the top 1% of earners, from whom half of all tax revenues are generated.

Proposed Wealth Tax

In a bold move to address this financial crisis, California is exploring the implementation of a wealth tax targeting its wealthiest residents.

Wealth Tax Rates

The proposed law includes a 1.5% tax on those with a net worth exceeding $1 billion and a 1% tax on net worths over $50 million. Additionally, the bill outlines methods for pursuing alleged tax evasion.

Taxing Non-Permanent Residents

The proposed tax would extend to both permanent and part-time residents of California. Part-time residents would face taxation proportionate to the time spent in the state each year.

Taxation of Former California Residents

The bill also seeks to tax individuals who have recently moved out of California. This provision aims to prevent tax avoidance by those leaving the state.

Scope of the Wealth Tax

The wealth tax would encompass a wide range of assets, including offshore financial holdings, business partnerships, and private equity interests.

Taxing Non-Public Assets

It would also apply to non-publicly traded assets, empowering the state Franchise Tax Board to audit private businesses outside California.

Exemptions in the Wealth Tax

The proposed wealth tax does not apply to real estate investments. This exemption could encourage the wealthy to shift their investments into real estate, possibly reflecting considerations for real estate sales and political donations.

Targeting Tax Evasion

The bill proposes to extend California’s False Claims Act to wealth tax filings, allowing lawsuits against individuals suspected of underreporting wealth. This could potentially redistribute wealth to plaintiff attorneys successful in such cases.

Projected Revenue

The wealth tax is estimated to generate around $21.6 billion, a figure insufficient to fully address the budget deficit or the rising costs of Medicaid, which has expanded to cover undocumented migrants.

Legislative Hearing

A legislative hearing on January 12th saw the rejection of the wealth tax bill by both Republican and Democratic lawmakers, citing its radical nature and public unpopularity. It was placed in a suspense file.

Reasons for Rejection

The bill faced rejection primarily due to its incomplete and poorly thought-out nature, with wide-ranging implications that were unpalatable. Additionally, it garnered significant public disapproval.

Impact on Proposition 13

Had the bill been passed, the wealth tax would have nullified Proposition 13, a constitutional amendment that limits property tax rates and assessment increases in California. This potential impact contributed to the bill’s unpopularity in the legislature.

Governor Opposes the Bill

California Governor Gavin Newsom also opposed the bill, considering it an unsuitable solution to the budget crisis.

Newsom’s 2024 Budget Strategy

Newsom’s fiscal strategy for 2024 seeks to reduce the anticipated $68 billion state budget deficit by nearly 50% through a combination of spending cuts and utilizing the state’s reserves.

Funding Delays and Program Cuts

California also plans to delay funding increases for higher education and cut proposed programs aiding vulnerable populations.

Cuts to Homelessness and Environment

Reductions in homelessness initiatives and environmental programs are also part of Governor Newsom’s deficit-reduction strategy.

Another Tax Hike

While the wealth tax bill failed to gain support in its January 10th hearing, a separate tax hike proposal for 2024 has successfully navigated through the legislative process.

Wage Tax Rate

The top effective marginal tax rate on wages will rise to 14.4% from 13.3%, stemming from a new law eliminating a wage ceiling on a payroll tax funding expanded family leave.

More from AllThingsFinance: Court Finally Unseals Secretive Case of Jan 6 Offender

Samuel Lazar sentenced for Jan. 6 insurrection; previously confidential case now revealed: Court Finally Unseals Secretive Case of Jan 6 Offender

Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

Jack Smith urges Judge Aileen Cannon for a speedy trial in a classified documents case involving ex-President Trump: Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

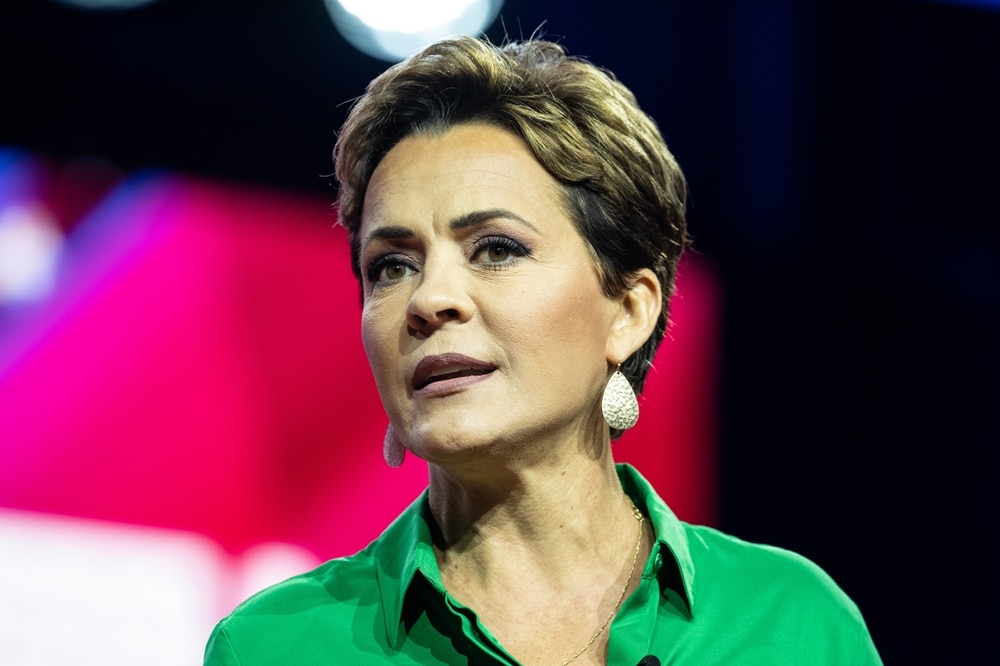

Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

Kari Lake loses First Amendment right to accuse Maricopa County recorder; Arizona Republic ponders if she’s channeling Rudy Giuliani in her sleep : Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

More Democrats are flipping in a crucial swing state than Republicans

In Pennsylvania, a significant number of registered Democrats flipping is sending an unflattering signal to President Biden: More Democrats are flipping in a crucial swing state than Republicans