California is grappling with a severe revenue downturn and a historic $68 billion budget deficit as a mass exodus continues to drain the state’s finances. But there’s more to the story.

What’s Behind California’s $68 Billion Budget Crisis?

The California Legislative Assembly kicked off its 2024 opening session on Wednesday with a critical task: resolving the state’s unprecedented $68 billion budget shortfall.

Record-Breaking Budget Deficit

The California Legislative Analyst’s Office (LAO) identified a sharp revenue decline as the primary cause of this deficit. Although this isn’t the biggest deficit in proportion to total spending, it’s unprecedented in actual dollar terms, potentially leading to significant consequences for California taxpayers soon.

The Aftermath of Natural Disasters

The delay in 2022-2023 tax collection is critical to California’s current revenue shortfall. After a series of natural disasters, including severe winter storms and landslides, the IRS extended the tax payment deadlines for most California counties to provide relief.

Tax Deadlines Altered

The original deadline of October 16, 2023, was extended at the last minute to November 16, 2023. In tandem, California postponed its deadline for state tax returns to align with the federal extension. This resulted in the state planning its 2023-24 budget without a complete understanding of the impact of recent economic challenges on state revenues.

A Historic 25% Drop

California experienced a 25% drop in total income tax collections for the fiscal year 2022-23, a decrease surpassing those of the Great Recession and the dot-com bust. Erin Mellon, the communications director for California Governor Gavin Newsom, explained to Fox News:

“Federal delays in tax collection forced California to pass a budget based on projections instead of actual tax receipts. Now that we have a clearer picture of the state’s finances, we must now solve what would have been last year’s problem in this year’s budget.”

Budget Plan for California’s Future

Moreover, she indicated that Governor Newsom plans to introduce a balanced budget proposal in January. This proposal will tackle the state’s challenges, maintain critical services and public safety, and concentrate on executing the state’s investments.

It will also focus on ensuring accountability and careful management of taxpayer money.

The Exodus Effect

California is grappling with a notable decrease in its population, resulting in fewer residents and businesses and a corresponding dip in tax revenue. The state faced its first-ever decrease in population in 2021, with a loss of approximately 281,000 residents, as reported by the Public Policy Institute of California (PPIC).

The decline persisted into 2022, with about 211,000 more people leaving, many heading to states such as Texas, Oregon, Nevada, and Arizona.

Why Californians Are Moving

Sky-high housing costs have been a critical driver of this trend, with a PPIC survey showing that 34% of Californians are considering a move out of the state due to these expenses. The shift towards remote work after the pandemic, which has left many urban office spaces empty, is also fueling this migration wave.

50% Drop in Home Sales

Since March 2022, the Federal Reserve’s series of 11 interest rate hikes, raising rates from 0.25% to 5.5%, have tightened the screws on borrowing and investment across California. This fiscal tightening has led to a significant 50% reduction in home sales and a sharp increase in mortgage costs.

Unemployment on the Rise

These changes have put a damper on business growth in the state, pushing the unemployment rate from 3.8% to 4.8% and increasing the number of jobless by about 200,000 since last summer.

California’s Deficit – What’s the Plan?

To bridge its $68 billion deficit gap, California has options like dipping into its $24 billion cash reserves, trimming school budgets to pocket $16.7 billion in savings, and reducing $8 billion in short-term spending. While these strategies offer immediate relief, the state has historically tweaked tax credits and hiked taxes for a revenue boost.

What to Expect

Erin Mellon announced that the Governor plans to roll out a balanced budget soon, centering on vital services, public safety, prudent investment, and careful handling of taxpayer dollars.

More from AllThingsFinance: Court Finally Unseals Secretive Case of Jan 6 Offender

Samuel Lazar sentenced for Jan. 6 insurrection; previously confidential case now revealed: Court Finally Unseals Secretive Case of Jan 6 Offender

Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

Jack Smith urges Judge Aileen Cannon for a speedy trial in a classified documents case involving ex-President Trump: Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

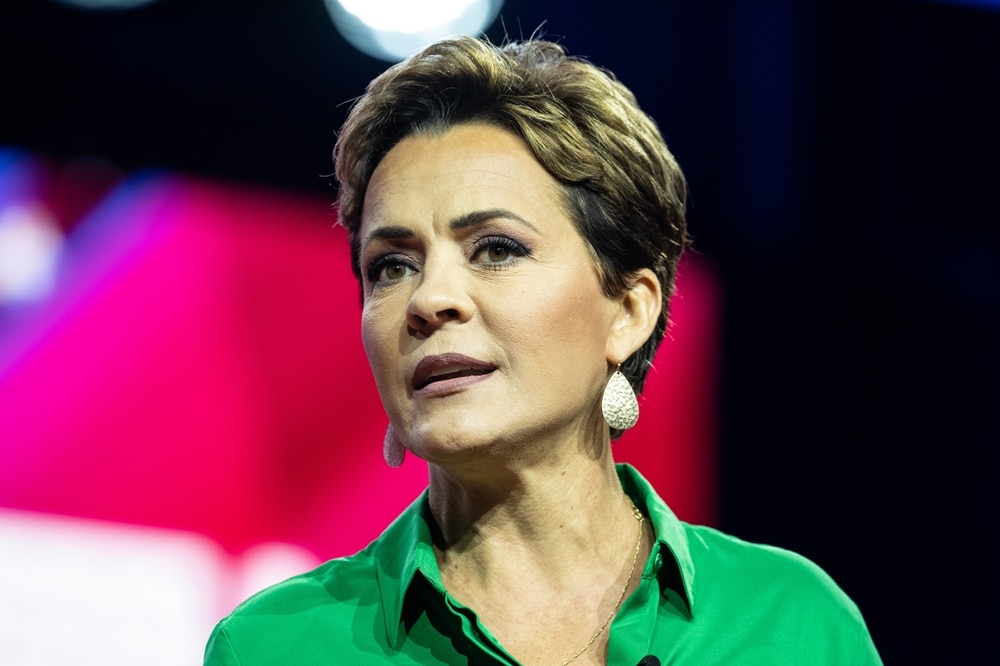

Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

Kari Lake loses First Amendment right to accuse Maricopa County recorder; Arizona Republic ponders if she’s channeling Rudy Giuliani in her sleep : Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

More Democrats are flipping in a crucial swing state than Republicans

In Pennsylvania, a significant number of registered Democrats flipping is sending an unflattering signal to President Biden: More Democrats are flipping in a crucial swing state than Republicans