The Hartford Financial Services Group Inc., also known as The Hartford, is the latest to join a growing list of insurers withdrawing from California.

Exiting California’s Insurance Market

They announced on Wednesday that starting in February, they won’t offer new personal property insurance in the state. The Hartford will stop offering new personal property insurance to residents of the Golden State, but the company assured the San Francisco Chronicle that current policies will still be renewed.

The Domino Effect

This move by The Hartford mirrors actions by other private insurers, including State Farm and Allstate, which both ceased issuing new policies in the state in November 2022, citing wildfire risks.

A Growing Threat to Insurance

Research indicates that the climate crisis is intensifying extreme weather events like wildfires, hurricanes, and tornadoes, with states like California and Florida facing a growing insurance crisis.

Fewer Options for California

Last year, several smaller insurance companies, including Merastar Insurance Company, Unitrin Auto and Home Insurance Company, Unitrin Direct Property and Casualty Company, and Kemper Independence Insurance Company, made it known they wouldn’t renew California policies in 2024.

Narrowing Choices for Homeowners

Consequently, California homeowners are seeing a narrowing of their insurance options, even as their homes become increasingly vulnerable to extreme weather events.

Strategic Shift for The Hartford

The Hartford, speaking to Newsweek, attributed the challenges unique to California’s homeowners’ insurance landscape as a key factor in reassessing their role in the market.

Announcing Policy Changes

Starting February 1, 2024, The Hartford will discontinue offering new homeowner policies. They emphasized the gravity of this decision and their support for measures like Commissioner Lara’s Sustainability Insurance Strategy, which aims to stabilize the market.

The Hartford Stays, But Differently

The Hartford also noted they will keep a close eye on these developments and maintain their other services in California, including renewing existing homeowners’ policies in line with their underwriting guidelines.

Market Share Insight

The Hartford holds a market share of under 1 percent in California’s homeowners insurance sector, as per S&P Capital IQ data. Meanwhile, Florida’s insurance scene has seen a significant exodus of major private insurers in recent years.

This has left many homeowners there in a bind, either struggling to find new coverage or opting to go without insurance entirely.

Crisis Hits Florida Hard

Experts speaking to Newsweek warn that Florida’s real estate market might face a downturn due to the ongoing insurance crisis. This crisis is fueled by major insurers leaving the state and the heightened risk of extreme weather events.

Real Estate Under Insurance Strain

Homeowners in Florida are currently dealing with the country’s highest insurance premiums. The average annual premium paid to private insurers is about $6,000, significantly higher than the national average of $1,700, as reported by the Insurance Information Institute, Barron’s, and CNN Business.

Below National Average

In contrast, Californians enjoy a more favorable insurance market, with an average yearly homeowners insurance cost of $1,380, well below the national average of $2,777, as reported by Insurance.com.

Prop 103’s Role

This lower cost is largely due to the enactment of Proposition 103 about 35 years ago, which transformed the nation’s largest insurance market. It requires the California Department of Insurance’s approval before changing property and casualty insurance rates.

Despite this, Prop 103 doesn’t empower California authorities to stop private insurers from discontinuing coverage in the state.

Tackling Insurance Crisis

In response to the worsening insurance market, California Governor Gavin Newsom, representing the Democratic Party, issued an executive order in September. This directive calls on the state’s insurance regulator to quickly take regulatory measures to stabilize the market.

The executive order emphasizes expanding insurance coverage options and improving the rate approval process in California.

Urgent Measures for California

California Insurance Commissioner Ricardo Lara, addressing the urgency of the situation, stated in a press release, “We are at a major crossroads on insurance after multiple years of wildfires and storms intensified by the threat of climate change.”

Revamping the State’s Insurance

Lara continued, “I am taking immediate action to implement lasting changes that will make Californians safer through a stronger, sustainable insurance market. The current system is not working for all Californians, and we must change course.”

Read Next: What Really Causes Donald Trump’s Skin to be So Orange

Former President Donald Trump’s distinctive orange skin has captivated attention, sparking curiosity about its evolution from average pale over the years:

What Really Causes Donald Trump’s Skin to be So Orange

27 Things MAGA Movement Ruined Forever for People

How the MAGA movement left its mark on individuals and disrupted certain aspects of our everyday life forever:

27 Things MAGA Movement Ruined Forever for People

Court Finally Unseals Secretive Case of Jan 6 Offender

Samuel Lazar sentenced for Jan. 6 insurrection; previously confidential case now revealed: Court Finally Unseals Secretive Case of Jan 6 Offender

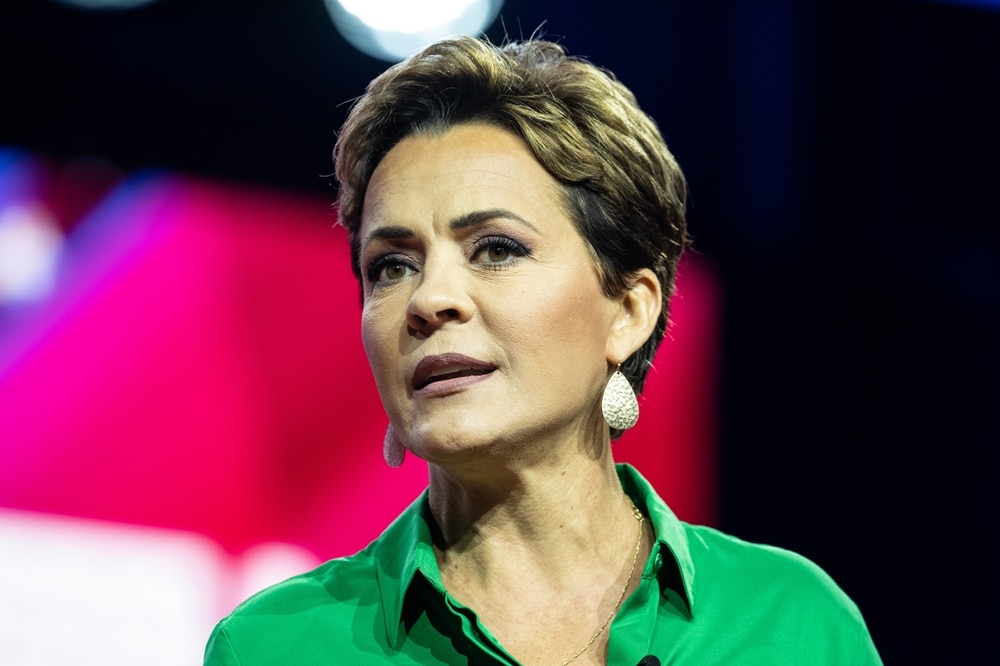

Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

Kari Lake loses First Amendment right to accuse Maricopa County recorder; Arizona Republic ponders if she’s channeling Rudy Giuliani in her sleep : Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

More Democrats are flipping in a crucial swing state than Republicans

In Pennsylvania, a significant number of registered Democrats flipping is sending an unflattering signal to President Biden: More Democrats are flipping in a crucial swing state than Republicans