John Driscoll, an executive vice president of Walgreens Boots Alliance, has called on lawmakers worldwide to increase taxes for millionaires like himself. He warns that the American dream is facing the threat of extinction.

‘Proud to Pay More’

Driscoll is part of a group of over 250 wealthy individuals backing the “Proud to Pay More” initiative. This business heavyweight is breaking norms by advocating for increased taxation on the wealthy.

Protecting the Dream

A descendant of Irish immigrants, Driscoll considers himself a product of the American dream, which promises that hard work leads to success in the US. His stance echoes that of other entrepreneurs, heirs, and activists, all striving to protect the rapidly fading American dream.

Elite Summit Hears Taxation Call

He endorsed an open letter from the “Proud to Pay More” campaign, addressing global leaders at the 2024 Davos meeting in Switzerland, a prestigious event attended by business and government elites, as well as media members.

A Millionaire’s Message

John Driscoll, in his statement, called on lawmakers globally to make a concerted effort to impose higher taxes on the wealthy, including himself. “In this spirit, I call on national and international lawmakers to do whatever it takes to tax wealthy people like me,” he wrote.

Not So Fast

Taxing the ultra-rich in the U.S. is far from straightforward; a substantial number of John Driscoll’s wealthy peers do not share his enthusiastic advocacy for increased taxation.

A Tough Crackdown

Last year, IRS Commissioner Daniel Werfel pointed out that budget cuts have made it difficult to monitor the intricate ways the richest taxpayers conceal income and avoid paying their fair share. As of October, the IRS had only managed to reclaim $122 million in taxes from 100 millionaires.

Musk’s Take on Tax Avoidance

In response to President Biden’s comment about wealthy individuals paying their fair share, billionaire Elon Musk shared his thoughts in June, saying, “I agree that we should make elaborate tax-avoidance schemes illegal, but acting upon that would upset a lot of donors, so we will see words, but no action.”

2% Tax Proposal

Tax experts have suggested measures that could significantly benefit the wider society. The EU Tax Observatory pointed out that a modest 2% tax on the world’s billionaires could generate approximately $250 billion annually.

Wage Equality

Beyond taxes, Driscoll has shown support for income equality, evidenced by raising the minimum wage to $15 an hour at CareCentrix under his leadership. In his tax-focused letter, Driscoll referenced an Economic Policy Institute report showing that in 2021, CEOs earned 399 times more than an average worker.

Bridging the Income Gap

Driscoll stressed, “If our world leaders want to prevent millionaires and billionaires and their children from becoming the accidental aristocracy, they need to ensure that these taxes work as meaningful and effective checks on dynastic wealth.”

Biden’s Tax Plans

President Joe Biden’s 2020 campaign prominently featured calls for higher taxes on the wealthy, continuing into his presidency with proposals like the Billionaire Minimum Income Tax. However, the Inflation Reduction Act, despite its $430 billion budget, didn’t directly raise taxes on the rich, diverging from Biden’s earlier tax plans.

A Public Opinion Shift

A Gallup update on a long-standing question about taxing the wealthy, originally asked in 1939 by Fortune, reveals changing attitudes. During the Depression’s peak, only 35% of Americans favored heavy taxation on the rich.

Majority Favors Wealthy Taxation

Opinions have shifted over time, with surveys in 2013, 2015, 2016, and 2022 showing a slight majority now favor such taxes. The latest results indicate 52% approval versus 47% disapproval.

200 Millionaires Agree

Last year, a group of over 200 millionaires, featuring Mark Ruffalo and Abigail Disney, advocated at the World Economic Forum in Davos for higher taxes on the ultra-rich, citing their disproportionate wealth amid global inequality.

‘Tax the ultra rich’

The coalition of 200 millionaires advocates for a progressive wealth tax, proposing a 2% tax on individuals with a net wealth of $5 million or above, 3% on those worth $50 million or more, and 5% on billionaires.

Their unified message, as stated in their letter, read: “Tax the ultra rich and do it now.”

More from AllThingsFinance: Court Finally Unseals Secretive Case of Jan 6 Offender

Samuel Lazar sentenced for Jan. 6 insurrection; previously confidential case now revealed: Court Finally Unseals Secretive Case of Jan 6 Offender

Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

Jack Smith urges Judge Aileen Cannon for a speedy trial in a classified documents case involving ex-President Trump: Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

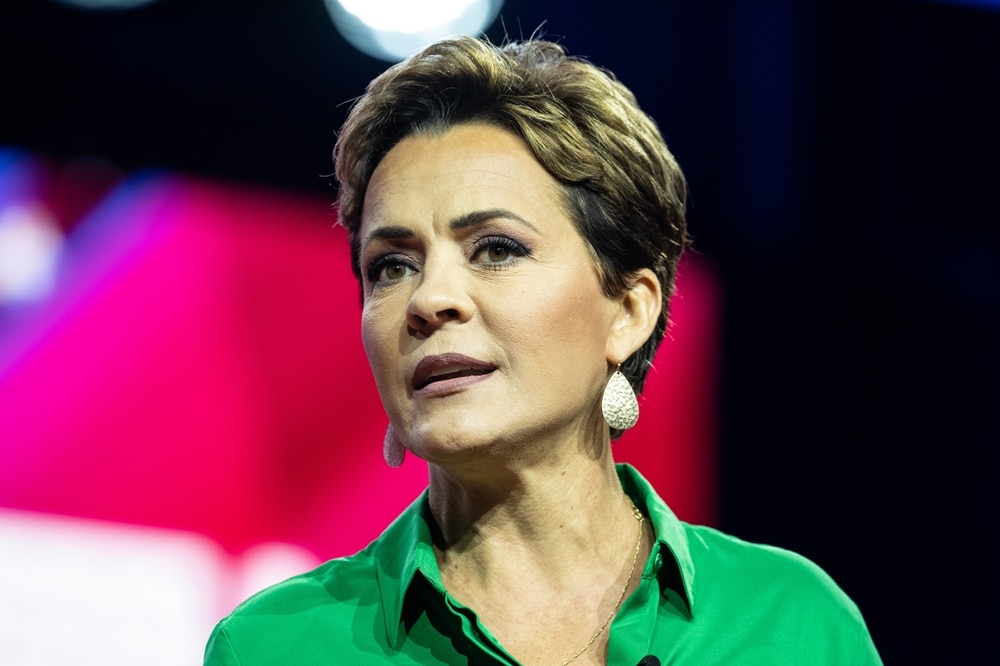

Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

Kari Lake loses First Amendment right to accuse Maricopa County recorder; Arizona Republic ponders if she’s channeling Rudy Giuliani in her sleep : Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

More Democrats are flipping in a crucial swing state than Republicans

In Pennsylvania, a significant number of registered Democrats flipping is sending an unflattering signal to President Biden: More Democrats are flipping in a crucial swing state than Republicans