Greg Abbott’s ambitious $18 billion property tax reduction for Texans became effective, but complaints of persistently high taxes are flooding in.

A Relief or Mirage?

With the $18 billion tax cut now in effect for Texas property owners, the plan has directed $12.6 billion from the state’s historic budget surplus to slash school taxes.

This move has resulted in more than a 40% average drop in property taxes for about 5.7 million Texas homeowners. The package also offers tax relief for smaller businesses and commercial and non-homesteaded properties.

Groundbreaking Tax Plan

Texas, known for its zero personal income tax—a draw for many newcomers—bears some of the nation’s steepest property taxes. In his 2022 re-election campaign, Abbott focused on lightening the financial load for Texans by introducing a property tax cut proposal. Voters in Texas strongly supported this measure, increasing the tax-exempt portion of a home’s value for school funding from $40,000 to $100,000.

$1,300 Annual Savings

Texans resoundingly backed Abbott’s groundbreaking plan, which should average out to a $1,300 annual property tax saving for residents, according to Republican Senator Paul Bettencourt from Houston.

Texans Cheer Tax Reduction, But…

Although most Texans praised the recent tax initiative, some have voiced skepticism, citing ineligibility for the homestead exemption or ongoing high property taxes despite the increased exemption. The blame isn’t solely on Abbott, as the appraisal system faces scrutiny.

“I’m devastated”

Tracy Williams recounted the startling escalation in taxes for their 5-acre home, originally bought for $16,000 in 1996, which now has an appraisal value of $350,000. “My property taxes are unbelievable,” Williams expressed. “I’m devastated.”

From $4,000 to $7,843

Similarly, Comanche resident Frank Porco, while set to benefit from the increased homestead exemption for his own home, is overwhelmed by the high property taxes on a property inherited from his parents. “Mom and Dad owned their home, and it was homesteaded, the tax was about $4,000,” he shared.

“Since I had to change ownership and I’m only allowed one homestead, last year I paid $6,500. This year, it’s $7,843. I am 72 and on Social Security, so with just the two homes and the lot I own next to them, my tax fees are about $12,000.”

Texans “Sinking”

Porco told Newsweek about his dire financial situation, overwhelmed by property taxes and car insurance payments. Feeling like he’s “sinking,” he’s now trying to sell his parents’ former home but is facing challenges due to the current state of the market.

“The market is really bad right now,” he said, “No one has even been here to look.”

Property Value Surge

Midlothian’s LuAnn Savage, 69, told Newsweek about her 55-acre property, ineligible for the homestead exemption, which is appraised higher than her other land and residence. She recounted an instance in 2017 when an appraiser noted a power pylon reduced the entire property’s value.

She added, “At that time, in 2017, that little strip was assessed at $8,500; it is now $90,000, and the new tax code allows the appraisal district to raise it 20 percent a year!”

Who’s at Fault?

LuAnn Savage is grappling with significant tax payments: the land in front of her house costs her $1,828.56 in taxes, while her home and 3 acres incur a $2,306.83 tax bill. At this rate, she predicts that next year, the tax on the 55-acre land with the electrical pylon will exceed that of her homestead.

Despite the strain, Savage doesn’t hold Governor Abbott responsible; instead, she points to the state’s appraisal system. “The Central Appraisal Districts need to be abolished and ELECTED people run them, not these bureaucrats!” she asserts.

A Pleasant Surprise

Not all feedback from Texas residents regarding the tax cuts has been negative. Helen Bateman, 84, is among those happy with the changes. She recounted her experience with a sense of relief, saying, “I was pleasantly surprised and checked and double-checked when I received the last of the three tax bills I got on my property.”

A “Godsend”

Expressing her contentment and referring to the tax reduction as a “godsend,” Helen Bateman added, “This was the school tax, which was over $1,700 in 2022 and over $400 in 2023, over $1,200 less! The other two taxes were less than last year but not by much,” she said. “Overall, I am pleased, and thank you, Governor Abbott.”

More from AllThingsFinance: Court Finally Unseals Secretive Case of Jan 6 Offender

Samuel Lazar sentenced for Jan. 6 insurrection; previously confidential case now revealed: Court Finally Unseals Secretive Case of Jan 6 Offender

Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

Jack Smith urges Judge Aileen Cannon for a speedy trial in a classified documents case involving ex-President Trump: Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

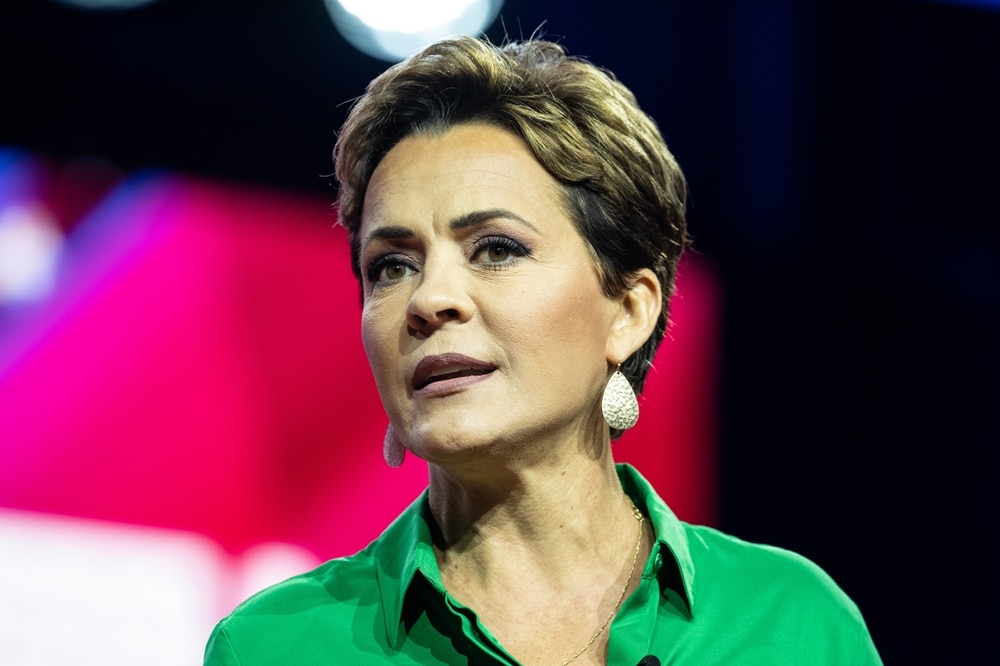

Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

Kari Lake loses First Amendment right to accuse Maricopa County recorder; Arizona Republic ponders if she’s channeling Rudy Giuliani in her sleep : Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

More Democrats are flipping in a crucial swing state than Republicans

In Pennsylvania, a significant number of registered Democrats flipping is sending an unflattering signal to President Biden: More Democrats are flipping in a crucial swing state than Republicans