In some ways, publicly traded companies are not that much different from individuals. They must generate income and a positive cash flow in order to operate just like you and I need a cash flow to survive and pay our bills. Not unlike individuals, a company can also file for bankruptcy if its obligations become unbearable and they don’t have the means to operate in their current state. There are several types of bankruptcy available , but an organization will primarily file for Chapter 11 to reorganize and attempt to become profitable again. Bankruptcy can beneficial if it allows the company to stay in business and continue to employee workers, but as an investor, you never want to invest in bankrupt companies.

In some ways, publicly traded companies are not that much different from individuals. They must generate income and a positive cash flow in order to operate just like you and I need a cash flow to survive and pay our bills. Not unlike individuals, a company can also file for bankruptcy if its obligations become unbearable and they don’t have the means to operate in their current state. There are several types of bankruptcy available , but an organization will primarily file for Chapter 11 to reorganize and attempt to become profitable again. Bankruptcy can beneficial if it allows the company to stay in business and continue to employee workers, but as an investor, you never want to invest in bankrupt companies.

Chapter 11 – Bankrupt Companies

I’m not going to get into the details of the complex bankruptcy laws, but it’s good to know a few key aspects. Chapter 11 is available to every type of business, from sole proprietorships to corporations. This filing is unique because it allows the business to continue its operations as opposed to Chapter 7, which requires that the company liquidate its assets and cease all business activities. I’m going to discuss why you shouldn’t invest in companies that have filed for Chapter 11. The fact that you should avoid stocks in Chapter 7 like the plague goes without saying and is not worthy of an explanation.

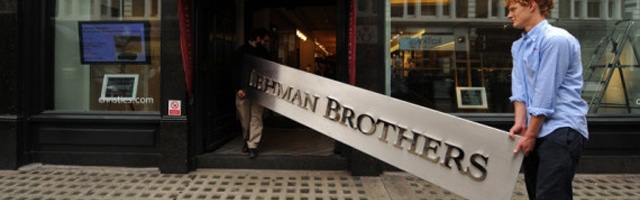

A lot of very well known companies have gone through bankruptcy in the last couple of years and continue to operate today with no distinguishable differences. I think this is where most investors get confused. Bankrupt companies like Delta Airlines, General Motors and other now defunct firms like Lehman Brothers and Enron all filed for Chapter 11.

Loss of Investment

Obviously, if you held shares of Lehman Brothers or Enron and you never sold them, you lost 100% of your investment because the companies are no longer trading. What about Delta and GM though? They are all still trading and their current stock price is much higher than it was when the company was working through the bankruptcy proceedings. This is a common misconception that can result in big losses for investors.

The shares of Delta and GM are NOT the same shares that traded before the company emerged from bankruptcy. If you held the pre-bankruptcy shares and never sold them, you’re in the same boat as the Enron and Lehman Bros shareholders – you lost your entire investment if you did not sell.

There exists a payout priority when it comes to bankruptcy. As a shareholder of common stock, you are dead last in line to receive any type of reconciliation from the firm. Before you come general creditors, debt/bond holders and then preferred security holders. If there’s anything left in the end, you may get some type of return on your investment, but don’t count on it. I’ve only seen this happen a handful of times in 10+ years.

Know when a company has filed for bankruptcy

If it’s a large, well known firm, the news will be hard to avoid. Even if you don’t keep up with CNBC or the Wall Street Journal, the symbol of the company will signify the bankruptcy by adding a ‘Q’ at the end. A symbol of ABCD will now be ABCDQ. If the company reemerges and issues new stock, the ‘Q’ will drop off and the root symbol may or may not change.

When to buy bankrupt stock

There’s only one scenario where I might approve of buying stock of a bankrupt company and that’s to trade it. The stock price will drop considerably so if you want to try your luck and attempt to make money off of the 5% – 15% swings each day, by all means, be my guest. Always be aware of the risks though. You may buy the stock on Monday with the intent of selling it the next day, only to wake up on Tuesday to find out the stock is gone and you lost your whole investment. At this point, it’s simply not worth the risk and your chances of making money are no greater than they are when buying typical penny stocks.

Readers: Who has made this unfortunate mistake and incurred losses as the result of purchasing securities in bankrupt companies? Has anybody made money by trading them?