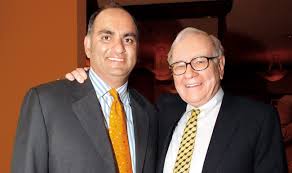

For starters who is Mohnish Pabrai… check out this article to find out!

Great, now that you have a background on our very successful friend Mohnish, lets take a close look at what makes him so successful. Many may be surprised to find out that he follows a very simple plan or checklist.

Mohnish Pabrai Investment Checklist

This checklist is outlined in his book: The Dhandho Investor: The Low-Risk Value Method to High Returns, Which is a great read for anyone seeking to make money from his or her investments.

- Focus on buying an existing business

- Buy simple businesses in industries with an ultra-slow rate of change

- Buy distressed businesses in distressed industries

- Buy businesses with a moat

- Bet heavily when the odds are overwhelmingly in your favor

- Buy businesses at big discounts to their underlying intrinsic value

- Look for low-risk, high-uncertainty business

Pabrai Philosophy

Much of Pabrai’s philosophy comes from the investment philosophy of Warren Buffett, Benjamin Graham, and Charlie Munger. Interestingly enough, Benjamin Graham is who Buffet and Munger have obtained most of their investment philosophy from. These three world-renowned investors have one piece of knowledge in common – the concept of value investing. Much of this can be ascertained from the checklist above, specifically number 6.

Value Investing

Pabrai refers to intrinsic value here, meaning the true value of a company. Every business has a true value, this philosophy arguing that at a high level – this refers to the cash flows a business generates per shareholder. Essentially – what does your ownership in a business represent? – this is a good question to ask here. For example, lets say you own a share of Google stock. Your financial analysis shows that Google stock per share should be worth $100, but it is currently selling for $50. Based on this analysis you would want to invest in the stock because it is “undervalued” to you. This is basically what value investing attempts to do: find companies that are undervalued, buy them and sell them once their price has appreciated. The hard part is as you could guess – the financial analysis that determines the value! One financial analysis may say a company is worth $50 per share and another says $80!

Learn More

I will leave the specific advice on financial analysis to the authors, but much can be ascertained by reading these key checklist points alone. Happy investing!

As mentioned, Pabrai’s book, The Dhandho Investor: The Low-Risk Value Method to High Returns is a great start.

I would also highly recommend taking a look at The Intelligent Investor.

I would also recommend these five books.