A tax cut bill for married couples filing jointly is now poised for discussion in the chamber, following an unforeseen revolt from moderate House Republicans in New York earlier this week, reports suggest.

Married Couples’ Relief

Four New York House Republicans—Nick LaLota, Anthony D’Esposito, Andrew Garbarino, and Mike Lawler—played a key role on Tuesday by delaying a procedural vote on unrelated bills, serving as a stark caution to the GOP for not incorporating a SALT reform in a bipartisan tax package aimed at increasing the child tax credit and reinstating some business tax breaks.

The $10,000 SALT Cap

In his 2017 tax reform, Donald Trump introduced a $10,000 SALT cap, which these dissenting New York House Republicans argue unfairly impacts taxpayers in Democratic-leaning states, where property and state income taxes are typically higher.

Legislative Threats

Following a strategy previously employed by GOP hardliners, Representatives Nick LaLota, Anthony D’Esposito, Andrew Garbarino, and Mike Lawler threatened to hinder legislative progress over SALT enhancements, reportedly securing a promise from their party to bring an amendment to the bill for discussion shortly.

Tax Relief Expectations

Reacting to the recent agreement, House Republican Mike Lawler, one of the key figures in the rebellion, expressed his anticipation on X (formerly Twitter), stating, “I look forward to the SALT Marriage Penalty Elimination Act coming to the floor and passing the House. Upon its passage, Senator Schumer must move it through the Senate asap. The hard-working taxpayers of #NY17 deserve nothing less.”

Fighting for SALT Relief

On Wednesday, Nick LaLota expressed on X, “I promised Long Islanders I would fight tooth and nail for SALT relief and vote against this year’s tax bill if it didn’t have a reasonable amount of SALT in it. Tonight I fulfilled that promise by voting against the Wyden-Smith tax bill.”

Pro-Family Tax Promise

He continued, “Thankfully, the fight for SALT isn’t over. Tonight I helped introduce the SALT Marriage Penalty Elimination Act, which would raise the joint filing deduction to 20k and ensure that we keep our promise to push pro-family and tax-cutting bills. Speaker Johnson has pledged to allow this bill to come to the floor next week. Stay tuned!”

SALT Deduction Limit

The amendment secured by the New York House Republicans, as revealed in the censored extract shared by journalist Laura Weiss on X, proposes to raise the deduction limit for married couples from $10,000 to $20,000.

Adjustments for Couples

This adjustment applies to “a joint return for a taxable year beginning after December 31, 2022, and before January 1, 2024, if the taxpayer’s adjusted gross income for such a taxable year is less than £500,000.”

Generous or Just Right?

Some view the $500,000 threshold for the SALT-related bill might be overly lenient, even for areas with strong Democratic leanings. On X, user @RyanLEllis remarked, “Pretty reasonable, but I think $500,000 is a little generous even for deep blue areas. I wonder if they didn’t get that much score going lower.”

Temporary Relief in Focus

Retroactively applying this amendment to December 31, 2022, means that it would be relevant for married households for the entirety of the previous year.

Weiss described this as “a very limited, temporary deduction increase for married couples” and relayed from a source that a meeting about the SALT bill is expected on Thursday morning.

Inside Congressional Plans

According to anonymous insiders cited by The Hill, Congress is expected to convene soon to deliberate on a bill concerning SALT. These sources anticipate the bill to be presented in the chamber under a regular rule instead of the expedited suspension process.

Additionally, Rollcall.com has reported that a vote on the SALT modifications could occur “as soon as next week.”

Bipartisan Victory

In a recent development, after appeasing the four New York House Republicans, the House successfully passed the $78 billion bipartisan Tax Relief for American Families and Workers Act on Wednesday evening, with a decisive vote of 357 to 70. However, it remains uncertain whether this bill will encounter similar ease in the Senate

Read Next: What Really Causes Donald Trump’s Skin to be So Orange

Former President Donald Trump’s distinctive orange skin has captivated attention, sparking curiosity about its evolution from average pale over the years:

What Really Causes Donald Trump’s Skin to be So Orange

27 Things MAGA Movement Ruined Forever for People

How the MAGA movement left its mark on individuals and disrupted certain aspects of our everyday life forever:

27 Things MAGA Movement Ruined Forever for People

Court Finally Unseals Secretive Case of Jan 6 Offender

Samuel Lazar sentenced for Jan. 6 insurrection; previously confidential case now revealed: Court Finally Unseals Secretive Case of Jan 6 Offender

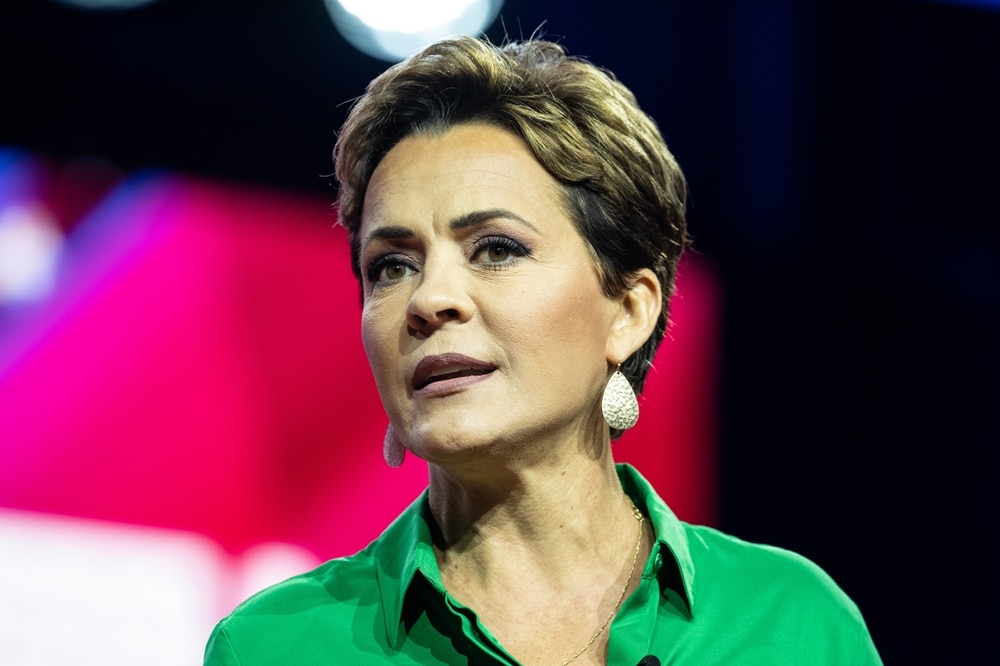

Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

Kari Lake loses First Amendment right to accuse Maricopa County recorder; Arizona Republic ponders if she’s channeling Rudy Giuliani in her sleep : Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

More Democrats are flipping in a crucial swing state than Republicans

In Pennsylvania, a significant number of registered Democrats flipping is sending an unflattering signal to President Biden: More Democrats are flipping in a crucial swing state than Republicans