China’s state-owned banks are tightening the screws on funding to Russian clients, likely because they’re scared of catching heat from U.S. secondary sanctions, according to a Bloomberg report.

What’s Happening?

The lowdown is that at least a couple of these banks are going through their Russian dealings with a fine-tooth comb, ready to sever connections with those flagged by U.S. sanctions.

They’re also hitting pause on any financial support to the Russian military industry.

The Broader Impact

And it’s not just Russian companies feeling the pinch; it’s also other players, including non-Russian firms, that do business in Russia or help funnel crucial goods to Russia via another country.

The U.S. Sanctions Threat

This action comes on the heels of the U.S. Treasury Department’s announcement last month, where they warned of secondary sanctions against international banks and financial institutions that aid Moscow’s military actions in Ukraine or assist in Russia’s military purchases.

A Sensitive Topic

Dmitry Peskov, the Kremlin spokesperson, referred to the tightening curbs by Chinese banks on Russian clients as a sensitive subject, mainly for the companies involved rather than the Russian government itself.

Strong Trade Amidst Strain

As per Reuters, Peskov emphasized, “This is a very, very sensitive area, and it is unlikely that anyone will undertake to talk about it—you shouldn’t expect that. We continue to develop relations with China. It’s our very important strategic partner.”

Strategic Ally

He maintained that the Russia-China relationship is still on solid ground, with China being a major strategic ally. On the trade front, Peskov boasted of their thriving trade dealings, with bilateral trade volumes with China shooting past the $200 billion mark and still climbing.

Chinese Banks Fill Western Void

As Western banks retreated from Russia in the wake of its Ukraine invasion on February 24, 2022, Chinese lenders filled the void, saving an economy that otherwise might have weakened significantly. Now, China stands as Russia’s largest fossil fuel customer, with its coal imports more than doubling since 2020.

Allies in Financial Uncertainty

The potential withdrawal of Chinese banks could be a hard blow for Russia and the Kremlin, mainly due to Beijing’s fear of Western sanctions. This suggests that even allies like China, who have maintained ties with Moscow since the Ukraine conflict began, are apprehensive about the financial fallout of backing the Kremlin.

Mixed Signals

Yet, this also mirrors China’s mixed stance towards Russia since the Ukraine invasion. While China has diplomatically backed Russian President Vladimir Putin and vowed to boost trade, it has refrained from fully endorsing the war in Ukraine or providing substantial military aid to Moscow.

Increasing Dependency on China

Western sanctions have significantly weakened Russia, pushing it towards greater dependence on China. These sanctions effectively blocked Russia’s central bank from accessing about half of its foreign reserves, leaving it with only gold and yuan as alternatives.

Rising Skepticism

Vladimir Putin has highlighted Russia’s close relationship with China, but economists are raising eyebrows over Russia’s growing reliance on Chinese trade.

‘Friendly’ vs. ‘Not-So-Friendly’

After the West hit Russia with sanctions due to Putin’s war in February 2022, Russia started tagging countries as either ‘friendly’ or ‘not-so-friendly,’ favoring the former with more attractive trade terms, particularly in oil and gas.

Surpassing Records

Even though China’s staying neutral on Putin’s war, they reported a record-breaking $218 billion trade with Russia from January to November 2023, surpassing the total for the previous year.

A New Financial Era

Following the suspension of Visa and Mastercard in Russia due to the invasion, Russian banks turned to China’s UnionPay. Chris Weafer, the CEO of Macro-Advisory Ltd. with a focus on Russia and Eurasia, warned about the risks of Russia’s increasing dependence on China.

“Very little investment coming into Russia”

He pointed out that while China is keen on purchasing energy and materials from Russia and exporting Chinese goods there, the level of Chinese investment in Russia is minimal. According to Weafer, this investment is nowhere near sufficient to make up for the loss of Western investment and capital.

More from AllThingsFinance: Court Finally Unseals Secretive Case of Jan 6 Offender

Samuel Lazar sentenced for Jan. 6 insurrection; previously confidential case now revealed: Court Finally Unseals Secretive Case of Jan 6 Offender

Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

Jack Smith urges Judge Aileen Cannon for a speedy trial in a classified documents case involving ex-President Trump: Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

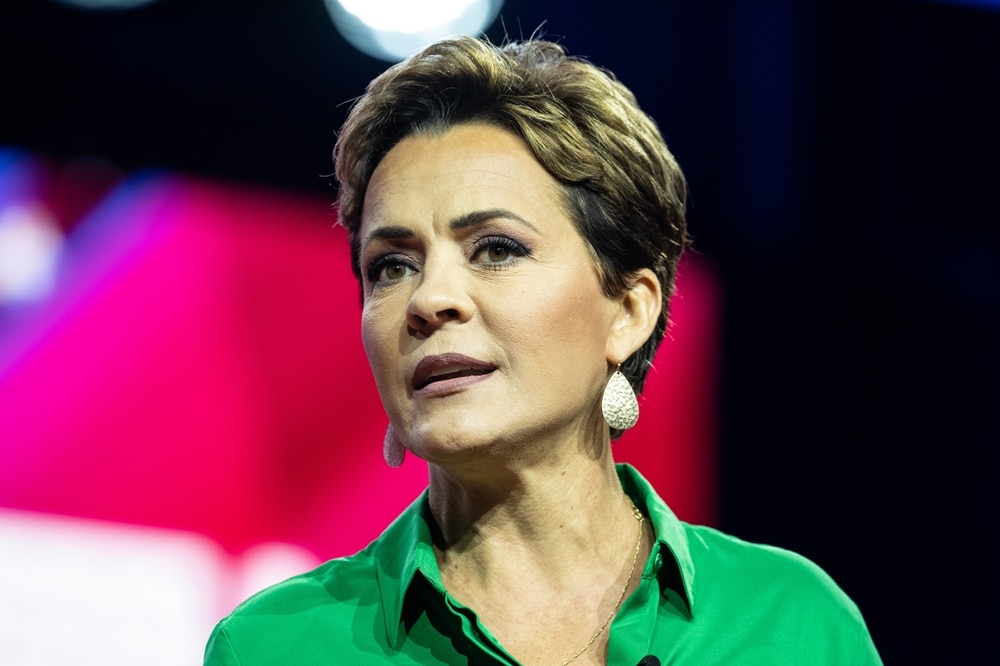

Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

Kari Lake loses First Amendment right to accuse Maricopa County recorder; Arizona Republic ponders if she’s channeling Rudy Giuliani in her sleep : Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

More Democrats are flipping in a crucial swing state than Republicans

In Pennsylvania, a significant number of registered Democrats flipping is sending an unflattering signal to President Biden: More Democrats are flipping in a crucial swing state than Republicans