Several Democrat-run states, including California and New York, have seen proposals to increase taxes on the highest earners. While these are unpopular with those affected, most Americans support them.

Tax the rich

Earlier this month, California assemblymember Alex Lee proposed a bill to tax the “extremely wealthy.” People worth over $50 million would be taxed at 1%. Those worth over $1 billion would be taxed at 1.5%

Large returns

Just 23,000 households in California — the richest 0.1% — would be impacted by the proposed tax. However, Lee estimated that it would bring in over $21 billion every year.

Much-needed cash

The extra revenue would be welcome in California, which this year saw its deficit rise to a record $68 billion. However, Governor Gavin Newsom has said he opposes any form of wealth tax.

Coast to coast

Lee’s proposal was part of a nationwide set of legislation introduced by progressive lawmakers. Such legislation was introduced in New York, Connecticut, Hawaii, Illinois, Maryland, and Washington, all around the same time in mid-January.

Targeting the uber-wealthy

Two proposed bills in New York would add a new tax on capital gains income and a tax on state residents with assets worth more than $1 billion. The bills join similar legislation introduced in previous years.

Follow the leader

In November 2022, Massachusetts voters approved a new 4% tax on state residents worth more than $1 million. At the end of 2023, the state Department of Revenue predicted the millionaire’s tax would generate over $1.5 billion, more than initially estimated.

Paying it forward

As the voter-approved legislation mandates, the extra money will be allocated to public transport, tuition-free community college, and universal free meals in public schools.

Forced to flee

Critics of the millionaire’s tax argued it would drive wealthy residents out of Massachusetts. In December, the Massachusetts Taxpayers Foundation found that the rate of people leaving the state was the highest in decades.

Widespread exodus

Critics claim that the same fate will befall California, New York, and any other state that implements a wealth tax. In August, Fortune cited a SmartAsset analysis to argue that wealthy millennials were leaving New York and California for Florida and Texas.

Unfair balance

Texas does not have a state income tax. However, a 2023 study by Fortune found that the effective tax rate for the median US household is actually more than 3.5% higher in Texas than in California.

Paying fair share

“When people are like, ‘Oh, California is so much more expensive than Texas,’ that’s the top income tax rate. That’s on people earning over $1 million,” explained Richard Auxier, a tax policy expert.

Other reasons

According to the June 2023 California Community Poll, 70% of Californians expressed high happiness with living in the state. Nevertheless, 40% of them are still considering leaving, with many citing the unaffordability of housing in the state as their reason for leaving.

Not going anywhere

In 2018, a study from Cornell found that “the rate of top earners leaving [California] actually declined slightly after the 2004 tax increase, while the almost-top earners continued to leave at the same rate.… In other words, the 2004 tax increase didn’t drive the people paying a larger bill out of the state.”

Popular proposals

In October 2022, YouGov released the results of a poll which showed that 52% of US adult citizens agreed that the government should reduce the gap between the richest and poorest. Only 10% believe taxes on billionaires are too high, while 57% thought they were too low.

Not going far enough

Additionally, 61% of respondents supported a 20% minimum income tax on households earning $100 million or more. Biden’s Billionaire Minimum Income Tax would do this.

Lost revenues

Currently, billionaires pay around 8% of their income in taxes. In 2021, the IRS estimated that wealthy tax cheats cost the US economy $1 trillion per year.

More from AllThingsFinance: Court Finally Unseals Secretive Case of Jan 6 Offender

Samuel Lazar sentenced for Jan. 6 insurrection; previously confidential case now revealed: Court Finally Unseals Secretive Case of Jan 6 Offender

Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

Jack Smith urges Judge Aileen Cannon for a speedy trial in a classified documents case involving ex-President Trump: Jack Smith continues pushing Judge Cannon, reminding her that “the speedy trial clock” is ticking

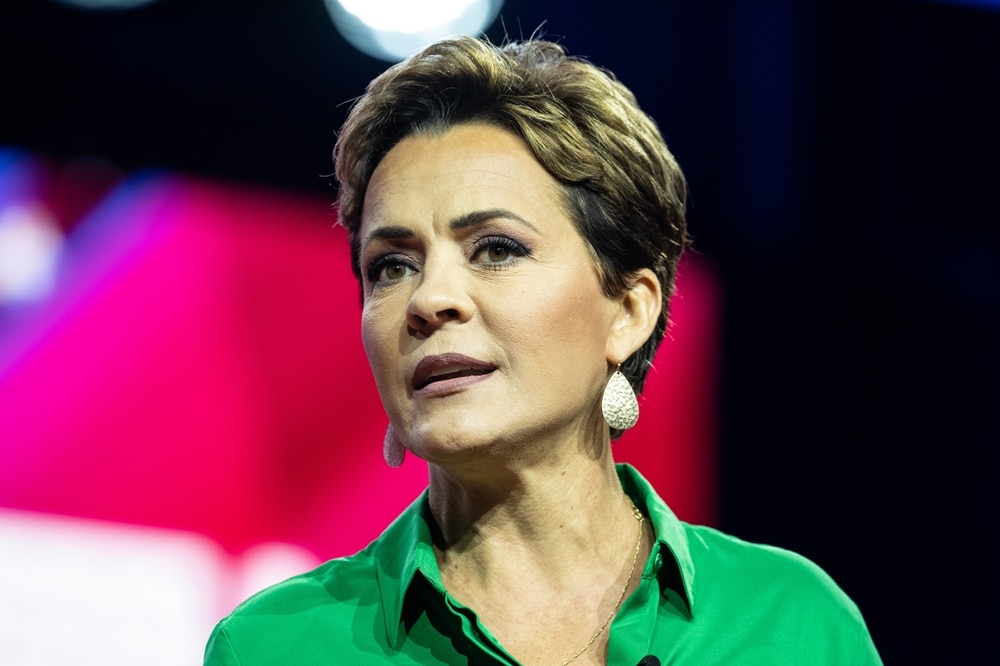

Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

Kari Lake loses First Amendment right to accuse Maricopa County recorder; Arizona Republic ponders if she’s channeling Rudy Giuliani in her sleep : Defamation lawsuit against Kari Lake advances while people compare her to Rudy Giuliani

More Democrats are flipping in a crucial swing state than Republicans

In Pennsylvania, a significant number of registered Democrats flipping is sending an unflattering signal to President Biden: More Democrats are flipping in a crucial swing state than Republicans