What would you do when you need to leave a certain job or if you are suddenly informed that the firm no longer needs you. You could be unemployed after being on the job for a number of years and it would take some time before you find the next one. After the dust settles in, you will soon realize that you need to manage your money at the same time. Now that money has stopped pouring in, but bills still needs to be paid nevertheless.

What would you do when you need to leave a certain job or if you are suddenly informed that the firm no longer needs you. You could be unemployed after being on the job for a number of years and it would take some time before you find the next one. After the dust settles in, you will soon realize that you need to manage your money at the same time. Now that money has stopped pouring in, but bills still needs to be paid nevertheless.

The Need of Emergency Funds

People who had planned things can attest to the fact that they were deeply grateful to have emergency funds in times of need. For those who did not foresee such a possibility, they will inadvertently tell how difficult it was to manage everything. Pre-planning is the key to weathering the storms we face in life. According to alarming statistics, a whopping 28% of Americans do not have emergency funds.

Essentially, an emergency fund is a fund set aside to deal with any contingency situation. This money, depending on how much it is, can allow you to live for some months until things get better. More so, you can deal with some unexpected costs, which might rear their ugly head at such inopportune times. It is an insurance policy of sorts to cover temporarily troubling times.

Determining an Amount for Emergency Fund

Now that the worst-case scenario has been fully laid out, it is time to look for ways to start an emergency fund and not just a stagnant one. It is actually much better to have an emergency fund that grows on its own, without your active involvement in its growth.

When you look for funds of this variety, you may notice some funds that provide you with this feature. Go for these funds rather than just saving money whose buying power decreases when inflation increases. Take some time out for this and allocate some money in this fund on a monthly basis. This will position you to tackle unforeseen circumstances when the time comes.

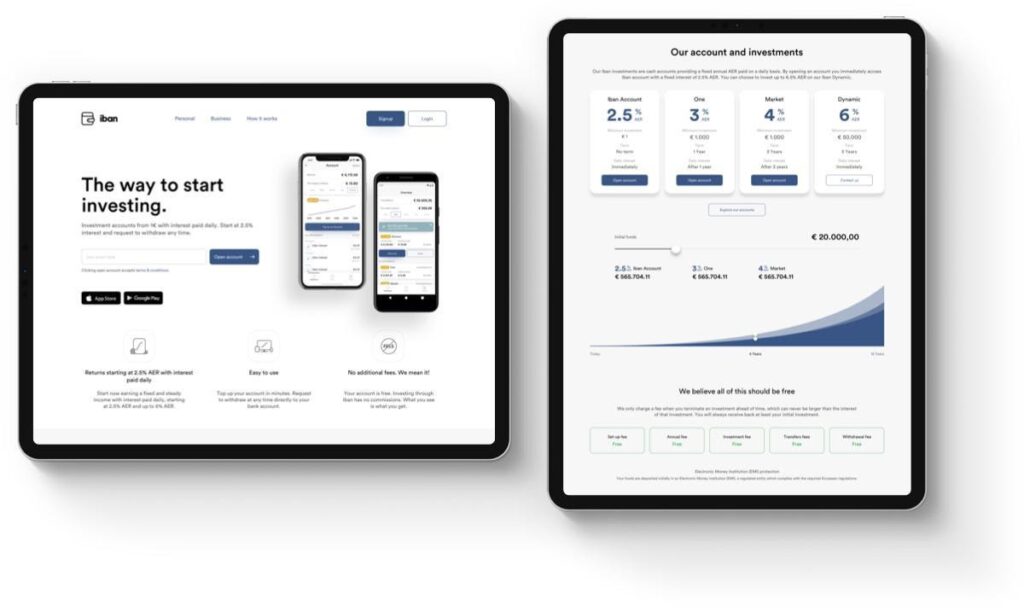

If you are looking for an option of our suggestion, then we would recommend Iban Wallet. It promises a range of benefits.

Iban Wallet – A Viable Reserve Fund

Based on a novel concept, this platform is excessively beneficial for the investors, non-investors and budding investors alike. With an entry barrier of just €1 for the basic account, you can deposit funds and watch them grow on a daily basis. For the basic account, the projected fixed rate of interest is 2.5%, but for the other accounts, the interest rates are projected to increase depending on their type.

As a result, the customers can get a return aimed to be from 2.5% to 6% based on the account they choose. The funds are liquid and you can request to withdraw them at any time you want. The investment platform is highly secure and minimizes the risk of investors via diversification.

Bottom-line

From the above discussion, it can be concluded that an emergency fund is highly beneficial but one that grows by itself, is even better.