If you look through the history of trading, you’ll see stock markets did not begin as the gargantuan behemoths they are today. The beginnings of trading wasn’t in stocks, as “companies” didn’t exist as they do today.

In 12th century France there were those, on behalf of banks, in charge of managing and regulating debts of agricultural communities. Because they traded not only in profits, but traded in debts, they were called the first brokers. The history of trading begins with a bit of a sad start doesn’t it?

In the early 1300’s, the family Van de Beurze helped to institutionalize what had been mainly informal meetings. People would begin to trade these commodities at localities, and soon this idea grew beyond them to other counties and countries.

Don’t get bored yet—later in the 1300’s Venetian bankers began to trade in government securities. Here’s the dicey part—some were spreading rumors to lower the price of government funds. Already people were recognizing and capitalizing upon investor fear.

In the 15th century Italian companies were the first to issue “shares.” England and the Low Countries followed suit a century later.

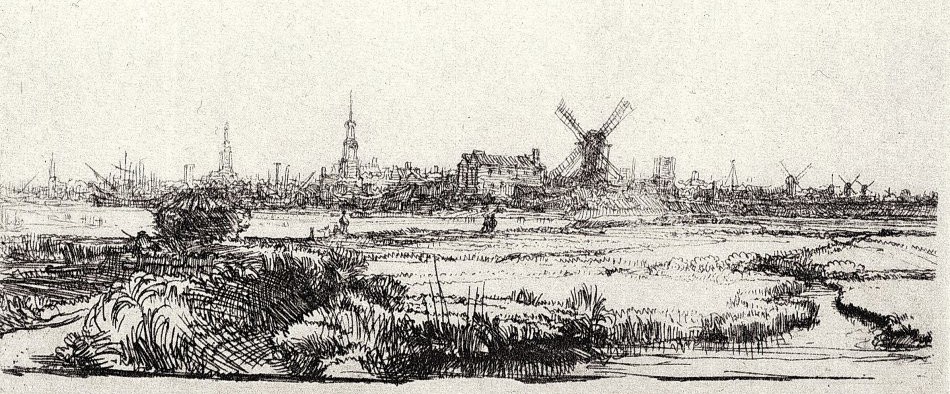

The Dutch East India Company was the first to become a joint-stock company. This meant the first fixed capital stock and as a result, there was continuous trading of this stock on the Amsterdam Exchange-the world’s first stock exchange which still exists today. Quickly derivatives such as options and repos emerged at this exchange. This lively trading environment also produced the first short-selling by the Dutch, which Amsterdam quickly outlawed incidently.

That’s the short version of the foundations of the history of trading. Of course as you get closer to the 19th century there was a huge acceleration and sophistication of the stock markets. We don’t get into that here. But what can we learn from the very first brokers and stock traders?

Ancient Stock Traders: What Can We Learn From Them?

1. Brokers

Money can be made while people are going broke or the economy is sliding downhill. That is a sad, but true statement. Betting, or “putting”, against the market at the right time can result in a tangible win.

2. Notional trading existed early on

Venetian’s were quick to realize that emotions and fear had the power to influence the valuation of commodities. Today, no less than in the past history of trading, are stock prices influenced by notion.

You and I can’t fix this ill, but we can do our best to guard ourselves from notional trading. Taking the emotion out of what you do is paramount. That takes form by writing down your investment plan, and when you are making stock or other purchase, setting limits or other orders to take the knee-jerk reaction out of trading.

3. Think outside the box

Early traders got creative very quickly. From spreading rumors, to creating a derivitives market, to the fact that selling shares in companies even began took major creativity from a people where these ideas never existed. Yes, they’re commonplace today, but back then these were primitive yet advanced concepts.

You may not found a new derivative market, but is there new information you can learn that will inform how you trade? Can you educate yourself out of your current investment “routine,” and advance and expand your investment opportunities?

That’s not to encourage anyone to try something too risky or attempt something that Amsterdam may one day consider illegal. It’s simply wise to continue to educate yourself on all things finance. Broaden your horizons and consider changes to your current strategy.

History of Trading: Why Do Companies Trade Publicly?

After all this you might question why trading publicly even exists. One simple answer to that is due to trading privately being so difficult. There is a “secondary market” for trading privately held shares in non-public companies. But because financial and other records don’t have to be as open to the public, it can be hard to valuate a private company.

Imagine when Facebook was still private. There were between hundreds to thousands of people that owned private shares in Facebook, and wanted to cash out and make enormous sums of money. To do that on a secondary market was difficult and tricky, not to mention a much smaller amount of buyers. One major reason for Facebook to go public was for those faithful workers with shares to financially benefit from being able to publicy trade Facebook’s stock.

Readers: If you could advise someone in the 16th century how to invest, what would you say? If you lived in the 25th century, what would you come back and advise yourself with today?

[Featured image courtesty of http://afbeeldingen.n3po.com/]

Read More:

Not All Investing Guru’s May Be Worth It – Case in Point Anton Kreil’s